On January 24, The Group hosted its Annual Real Estate Forecast, a much-anticipated event for both real estate professionals and the broader community of Northern Colorado. Similar to past years, Group President and CEO Brandon Wells recapped some of the overarching themes we saw in 2023 and detailed various trends that are likely to shape the housing market in 2024. Most notably, Wells discussed the “lock-in effect” we experienced in 2023, as buyers sat on the sidelines waiting for the potential of lower interest rates, while sellers stayed “locked in” to their lower rates, hesitant to trade their lower rate for a higher one. He predicted there will be some thawing of this freeze on both sides, as buyers return to the market and sellers become willing to part with their lower rate.

During the forecast, we also heard from Jason Peifer, president of Group Mortgage, who discussed mortgage interest rates. Plus, Wells shared the stage with Larry Kendall, co-founder of The Group and author of Ninja Selling, who discussed the Boulder Benchmark and some overarching historical observations after living in Northern Colorado and being immersed in the industry for more than 50 years.

Let’s take a closer look at some of the prominent trends that emerged and shaped the real estate market in Northern Colorado over the past calendar year, and how they will in turn shape the months ahead.

Predictions vs. Reality

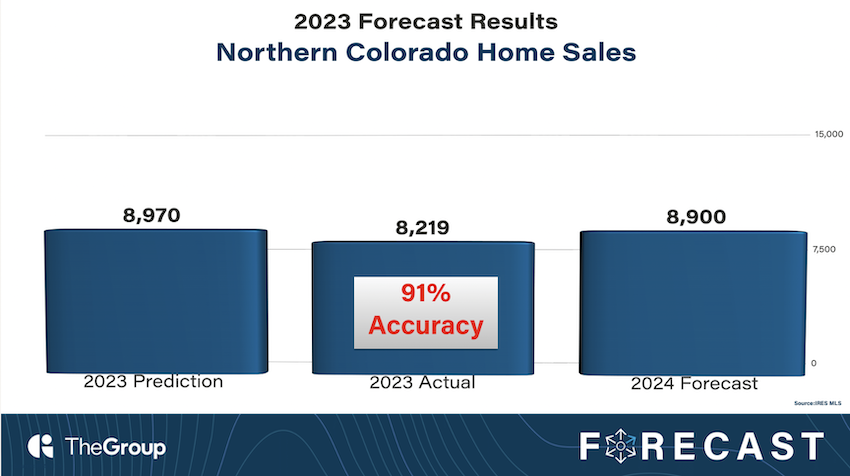

Over the years, our forecasts for home sales and average sales price have been between 95 and 99 percent accurate. This year, we were slightly less accurate with our prediction for the number of homes sales, with 91% accuracy. During last year’s forecast, we predicted there would be 8,970 home sales in Northern Colorado in 2023. But in reality, there were only 8,219 home sales.

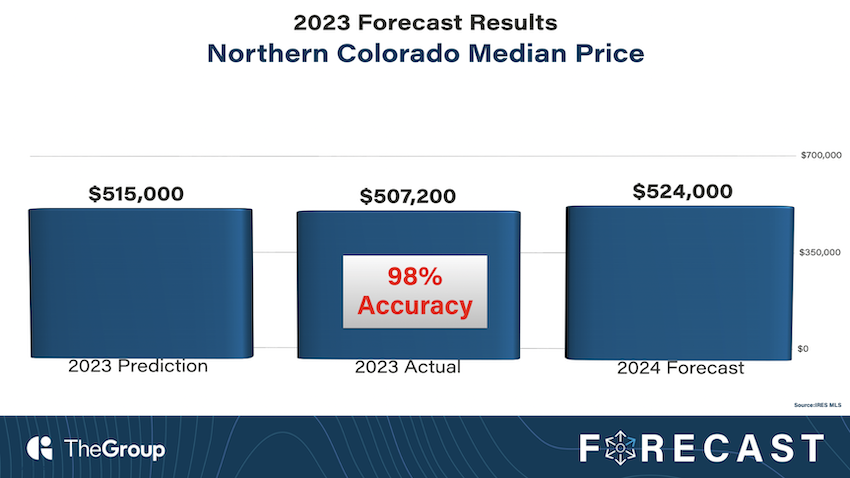

On the other hand, our prediction for median price was much more accurate. We predicted a median price of $515,000 in Northern Colorado in 2023, and the actual median price was $507,200, which means our prediction was 98% accurate.

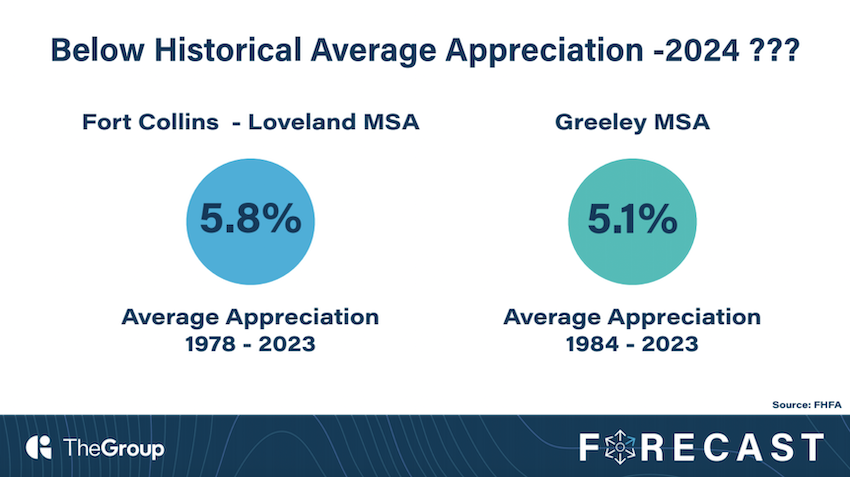

We predicted that housing prices would be relatively flat in 2023, with a return to the hyper-local nature of the market — and that’s exactly what happened. The average annual appreciation for Fort Collins and Loveland since 1978 is 5.8%, and it was 2.7% in 2023, which means we’ve seen a little slow-down since the double-digit appreciation we saw in the last couple of years. Houses are still appreciating, just at a slower rate.

Our Predictions for 2024

For 2024, our prediction is 8,900 home sales, which represents a 5-8% increase in home sales year over year in our region. We predict a median price of $524,000, which is higher than what we saw in 2023 at $507,200.

Read on to learn more about the major themes we can expect to emerge throughout 2024.

Soft Landing

There have been many conversations about whether or not our country’s economy will go into an economic recession. We do not think we will enter a recession, but will instead experience a soft landing, for several reasons.

It’s no secret that remote work has impacted our economy and will continue to. As it pertains to real estate, this will impact commercial real estate, as many businesses signed long-term leases, many of which are now coming to maturity, so companies are reevaluating their need for office space. Another factor that impacts the economy is credit card debt, as consumer consumption has continued to grow even in the face of inflationary pressures.

On the other hand, we can expect a soft landing because we predict the “lock-in effect” will improve in 2024, as both sellers and buyers re-enter the market. There has also been impressive wage growth. Surprisingly, wages outpaced inflation in 2023, which means we have gotten on top of some of those inflationary pressures.

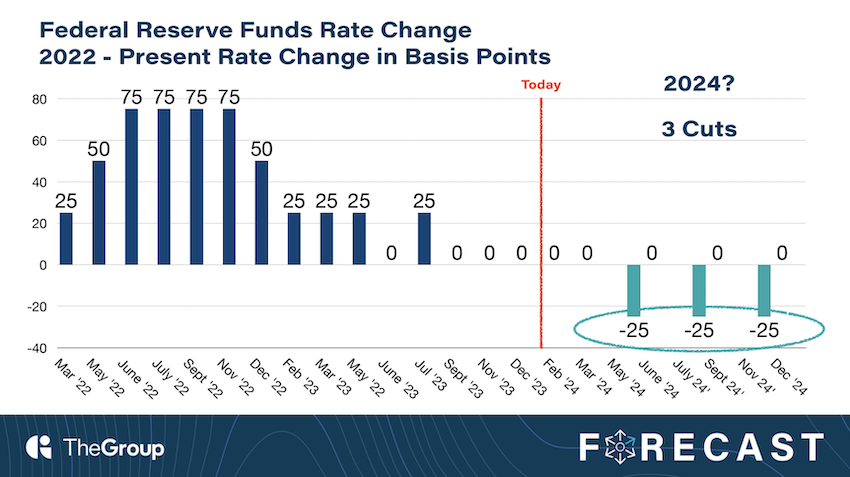

The Federal Reserve had 11 rate change raises throughout 2022 and 2023, and they have indicated they will start to cut rates in 2024. Exactly when those cuts happen and by how much is a major variable as it pertains to affecting mortgage rates.

Interest Rates

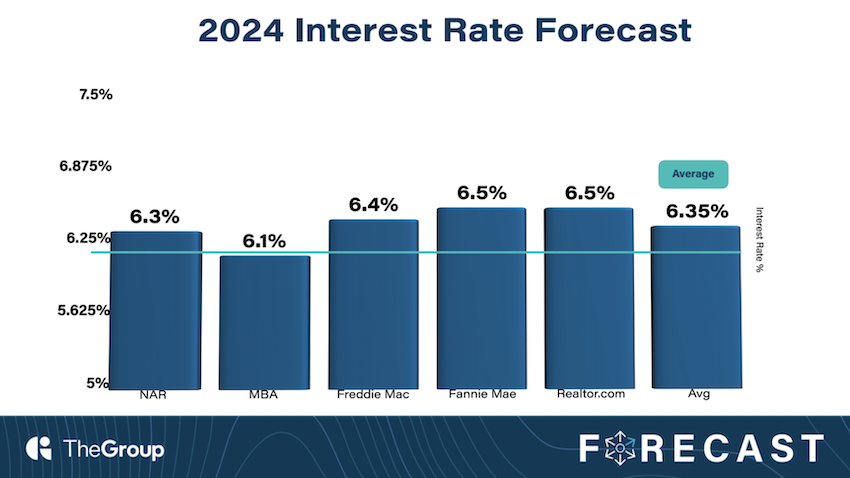

To talk about interest rates, we welcomed Jason Peifer, president of Group Mortgage, to the stage. Once again, he encouraged us to look at interest rates over the course of the last several decades, as opposed to the last five years, when rates were historically low. Peifer shared that pretty much every entity, from Freddie Mac to Fannie May, is forecasting lower interest rates in 2024. He is optimistic about the future of rates because “the Fed is now on our side,” but remains cautious because if we were to see a minor decrease in rates, it could have an opposite effect on the market.

Peifer warned us there are two distinct possibilities: rates could go up or down, and for each scenario, there are benefits and challenges. If rates increase, affordability will likely decrease and inventory will be extremely limited due to the lock-in effect. And if they decrease, competition will increase and prices will likely go up, affecting affordability for buyers. In both scenarios, Peifer has straight-forward advice: Buy now.

Institutional Buyer Myths

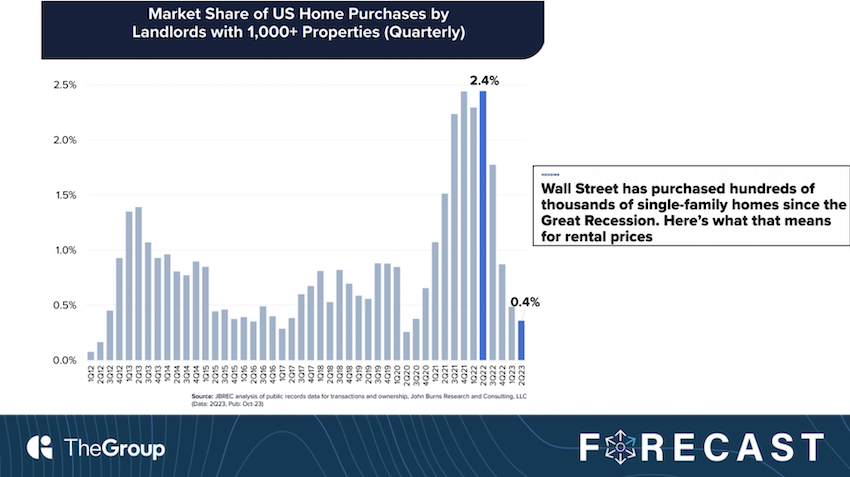

Wells discussed a couple of myths related to institutional buyers — and dispelled them. First, he talked about the fear that Wall Street has been aggressively snagging homes, which has impacted rental prices and affordability for buyers. However, when you look at the numbers, U.S. home purchases with landlords that have more than 1,000 properties only comprises about 0.4% of the market share.

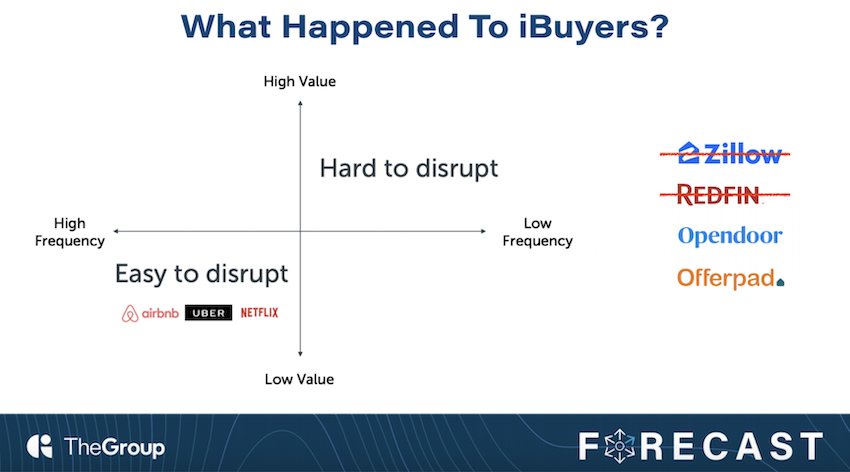

Similarly, there was a fear that iBuyers, or real estate companies that use technology and algorithms to buy and resell homes quickly, would take over the market. But that just hasn’t happened with real estate, as it is a high value and low frequency sector. It’s much easier for technology to disrupt things that are low value and high frequency, much like the way Uber, Netflix and Airbnb disrupted their respective markets. Wells reassured us that iBuyers aren’t as prominent as they once were. In fact, Zillow and Redfin have already exited the iBuyer market due to failure, and platforms like Offerpad and Opendoor may not be far behind. This proves that a trusted advisor who understands the local real estate market will always reign supreme.

Employment & Population Trends

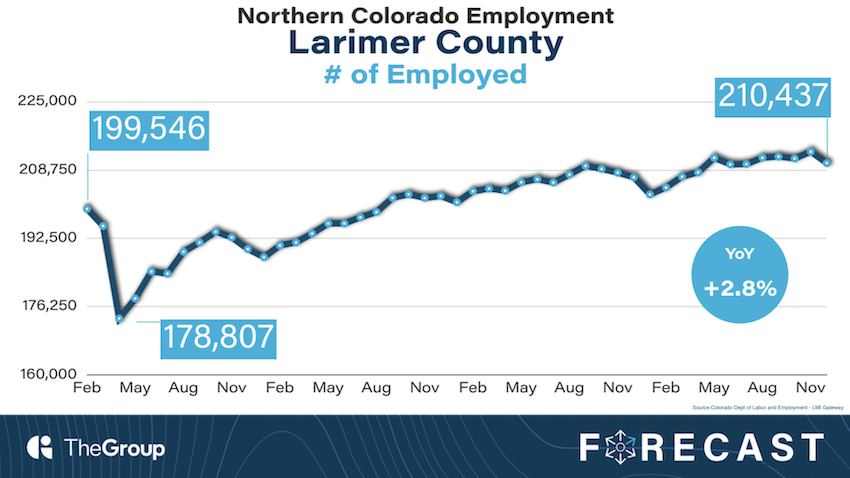

2023 was an excellent year for employment and population growth in Northern Colorado — and this trajectory is expected to continue. In Larimer County, employment recovered to above pre-pandemic levels, with a 2.8% increase year over year, which is significantly higher than the 0.08% growth rate we saw in Colorado last year. Weld County recovered to pre-pandemic levels and stayed pretty steady, with a slight year over year decrease of -.04%. And Boulder County recovered to above pre-pandemic levels with a year over year increase of 1.5%.

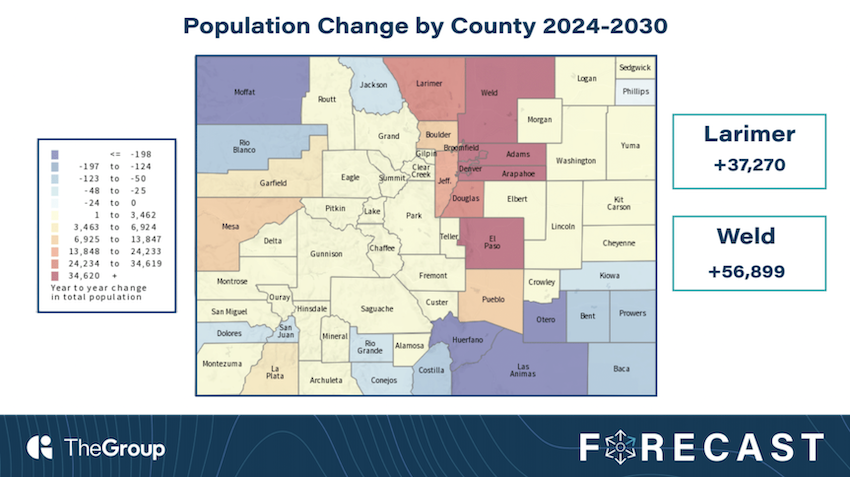

As far as population goes, the state of Colorado is expected to see population growth of 61,600. Across the board, in-bounding migration is slowing after the intense pandemic growth, but is still positive, with most of that growth happening in more urban areas. Most notably, the prominent growth for the whole state is centered in Larimer and Weld Counties, which together encompass 23% of the projected growth for the state.

Generational / Ancestral Housing

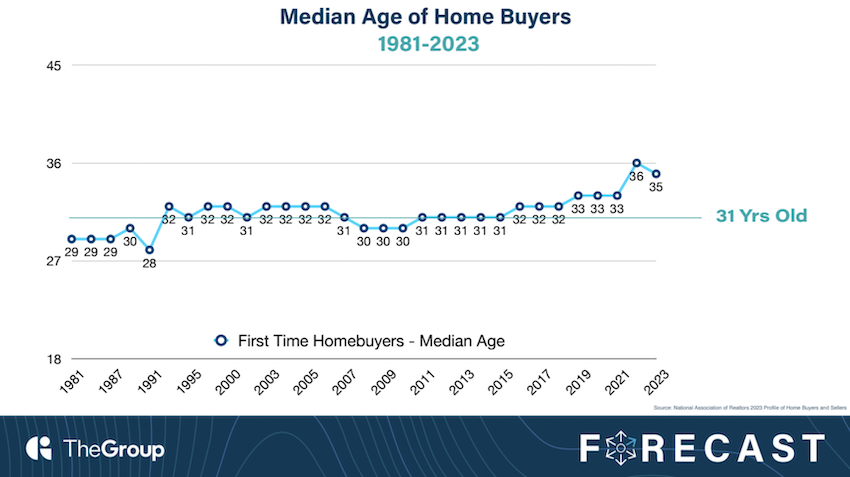

Generational living also had an impact on the housing market in 2023 — and will likely be a part of the story in the years ahead. In 2023, first-time buyers made up 32% of the number of total homes purchased, which is up from the previous year’s 26%. However, this percentage is still below the 38% average seen since 1981. Since that year, the median age of homebuyers is 31, but during the last two years, the age was 36 and 35. Buyers are entering the market later in life, largely due to many of the economic factors discussed above.

As a result, families are now having to plan financially to help their children with higher education AND housing, and many are turning to multi-generational living to make housing more affordable. In fact, 14% of home buyers purchased a multi-generational home last year, whether it was to take care of aging parents, for cost savings, or because of children or relatives over the age of 18 moving back home.

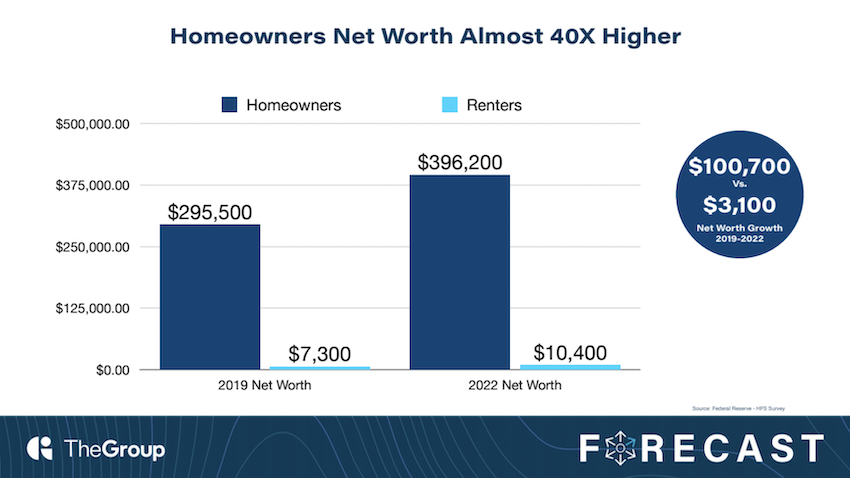

Wells urges us to “give your kids a chance,” emphasizing the significance of real estate as a wealth-building tool. Despite what news headlines might have you believe, the disparity between the net worth of a homeowner and a renter is massive. From 2019 to 2022, the average net worth of a homeowner grew by $100,700, while the net worth of a renter only grew by $3,100 — that’s almost 40 times the growth!

The Boulder Benchmark

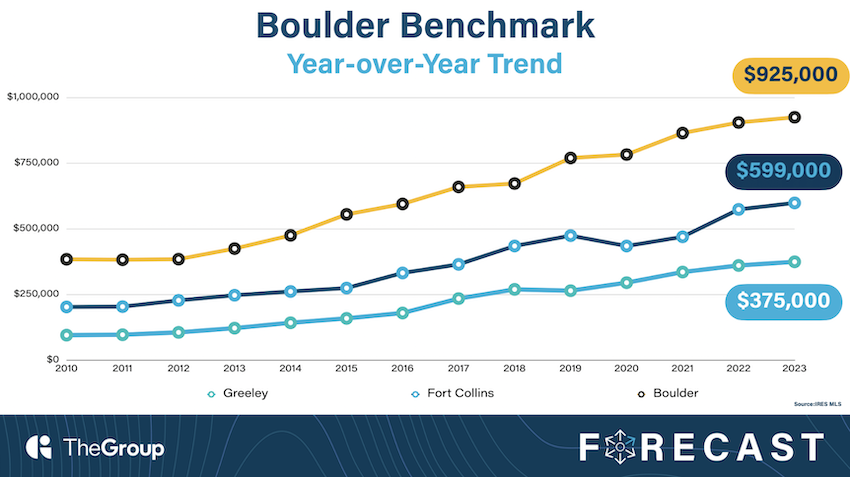

One of the tools we use to understand the local housing market is the Boulder Benchmark. This comparison examines three homes: one in Boulder, one in Greeley and one in Fort Collins. Carefully selected, each home was built by the same builder around the same time, has the same number of beds and baths with comparable square footage, and was sold in 2023.

This year, we invited Larry Kendall to the stage to discuss the Boulder Benchmark and give us some insight into the history of this metric — and why it’s so important. Watch the Boulder Benchmark to see how this year’s homes compared.

Workforce Housing / Attainable Housing

Kendall also discussed workforce housing, when companies provide housing for their employees, which makes housing more affordable for those individuals. He also mentioned that the community has to get on board with workforce housing if they truly want to see more affordable housing options in Northern Colorado. Similarly, he would like to see more condominium options, as many first-time buyers enter the housing market by buying a condo, thus increasing affordability and stimulating the market.

What to Expect in 2024

So what’s next for real estate in Northern Colorado in 2024? We predict the freezing effect is going to experience significant thawing with the potential for the improvement of interest rates in the back half of the year. While Wells sees “a light at the end of the tunnel,” he adds the caveat that there is a crowd of people ready and eager to buy at the end of that tunnel. This can produce some challenges. Namely, if we do not have the supply to satisfy that demand, we could find ourselves in another hyper-seller’s market. To mitigate this, new construction is key. The National Association of Home Builders is predicting a 4% increase in new home starts in 2024, which is significant because new builds comprise 31% of total available homes.

Wells urges buyers to not try to time the market. Sure, rates may come down, but that means housing prices would likely go up! He also reminds buyers to not forget about new construction during their home search. Wells’ advice to sellers is to list their property now instead of waiting. There is a lot of uncertainty ahead, and inventory is currently incredibly low, which means good quality homes in good locations are still desirable.

Watch the Forecast + See More Statistics

If you missed our Annual Real Estate Forecast, you can watch it here. Plus you can download the presentation slides and our 2023 Annual Report for more in-depth information and graphs.

Comments